Meeting Insights: Waco City Council Meeting – 08/04/20

By Jeffrey Vitarius

(Civic meetings happen in Waco every week – city council, school board, planning commission, and countless others. Decisions from these meetings affect our lives every day. Many of us are curious about these meetings, but to be honest, it’s just too hard to decipher the jargon and figure out what’s going on and why it’s important. Act Locally Waco is trying something new in August! Jeffrey Vitarius follows civic meetings for his work and out of personal interest. Each week in August he will pick a meeting in our community and highlight one or two items from the agenda to translate from “government-ese” into language we can all understand. We’re calling the series “Meeting Insights.” Let us know what you think! If you enjoy it, we will try to keep it going! — ALW )

The Waco City Council meets every other Tuesday. The work session starts at 3:00, that is where most of the explanation and discussion happens. The business session is at 6:00, that is when the council takes action (votes). The public is invited to attend either or both of these sessions, although, for the time being due to COVID-19, that attendance is virtual through the Waco City Cable Channel (WCCC.TV/live) with public comments sent in ahead of time. Today we will highlight Work Session Agenda item 3…taxes.

Meeting Basics

- Work Session – 3:00 pm / Business Session – 6:00pm

- To watch the live stream click here (City of Waco Cable Channel, wccc.tv)

- For the full agenda click here

- For the meeting packet with the documents pertinent to the meeting click here. I will refer to page numbers from this packet in the notes below.

- Details on how to provide public comment are listed in the agenda

Work Session Agenda item 3 – WS-2020-508 – Discussion of the Property Tax Certified Appraisal Roll and Certified Estimate of taxable value, as well as information on the No-new-revenue Tax Rate, the Voter-approval Tax Rate, and the Tax Collection Rate.

Agenda item 3 is just one part of an ongoing budget process. So, let’s start with a bit of a timeline. Two weeks ago, city staff talked through preliminary budget projections with City Council (minutes and video). Since then city staff has received a certified estimate of tax value (more on that below) and developed a proposed budget and tax rate. This week the council will discuss these proposed items and set a public hearing on the budget (tentatively – 9/1) and the tax rate (tentatively 9/1 with vote on 9/8). In today’s “Meeting Insights” we’ll zero in on the tax rates.

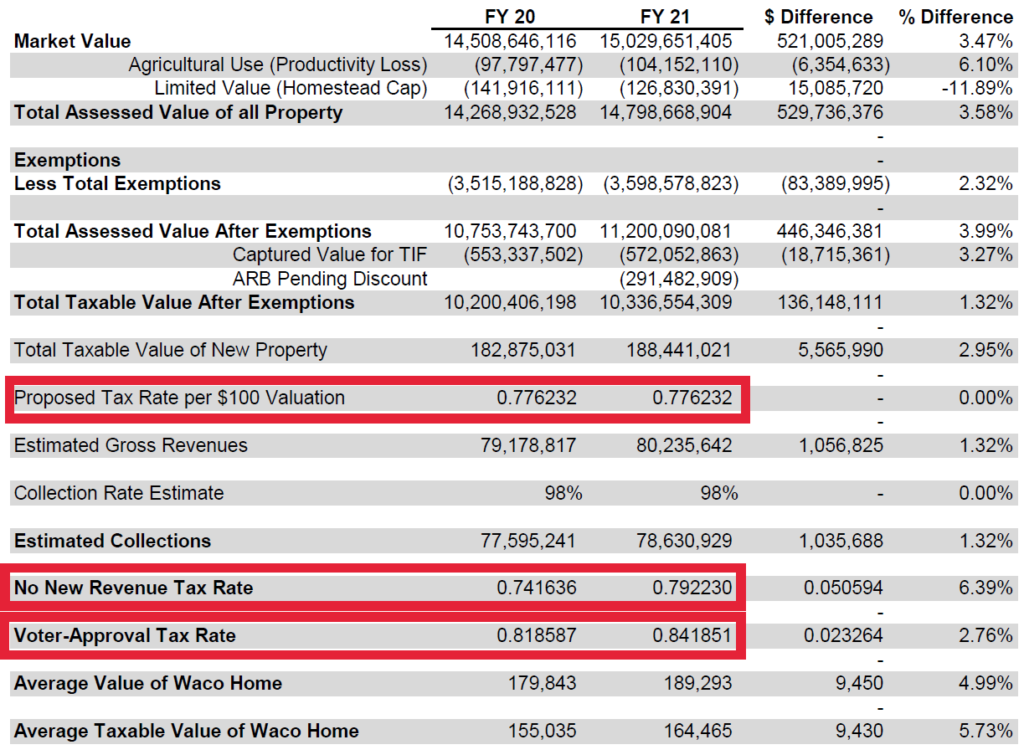

The image above comes from this week’s meeting packet and lists three kinds of tax rates: the Proposed Tax Rate, the No New Revenue Tax Rate, and the Voter-Approval Tax Rate.

Most of us are familiar with the Proposed Tax Rate – that’s the rate we would pay should it pass. The city applies this rate to the values it receives from the McLennan County Appraisal (MCAD) to calculate its property tax revenues for the year.

The “No New Revenue Tax Rate” is the rate that would generate the same revenues as the last year, taking into account changes in appraised values. In other words, if property values went UP last year, the No New Revenue Tax Rate would go DOWN – because a lower rate would get the city the same amount of revenue. If property values went DOWN last year, the No New Revenue Tax Rate would go UP – because the city would have to charge a higher rate to get the same amount of revenue. As the name implies, it is the rate that would result in “No New Revenue.”

(Note: The No New Revenue Tax Rate does not take into account new property. It looks at the property from last year’s appraisal roll, and the revenues from those properties, not new properties that may have come on the roll since.)

This year provides an interesting example. The value of taxable property from last year went DOWN compared to the year before. On net, properties last year declined in value. So, the No New Revenue Tax Rate this year is higher than the Property Tax Rate from last year. If there were no new properties, the city would expect to collect less in property taxes than it had the previous year if the Property Tax Rate remains the same.

Why does the city calculate the No New Revenue Tax Rate? Because you need that rate to be able to calculate the Voter Approval Tax Rate. The “Voter Approval Tax Rate” is the maximum rate allowed by law without voter approval. These two rates are connected by a multiplier that is decided by the Texas Legislature. The multiplier changes from time to time, but currently the Voter Approval Tax Rate is basically the No New Revenue Tax Rate X 3.5%. (I say “basically” because some adjustments are made to take into account debt service.) In other words, the city may not impose a Property Tax Rate more than 3.5% times the rate needed to collect the same tax revenues as the previous year. (The language around tax rates can be somewhat confusing. If you are interested, here is an explainer from the Texas Municipal League with much, much, much more information.)

For the past six years, the city’s tax rate for property taxes has been “0.776232/$100” or about 78 cents for every $100 of property value. The city’s income from property taxes has steadily increased over the last six years because the value of taxable property within the city limits (and the addition of new property this year) has been steadily on the rise, not because the city has increased its tax rate. In the 2019-2020 budget property taxes made up a little less than a third (29%) of the city’s operating budget.

For this fiscal year, the city is projecting to continue the $0.776232 per $100 tax rate from previous years. Since this rate is less than both the “No New Revenue Tax Rate” and the “Voter-Approval Tax Rate,” no tax-rate election will be necessary. If all proceeds as proposed, the average homeowner would pay $1,276.63 in city property taxes next year.

Here is another interesting point: the chart above shows a number called “ARB Pending Discount.” What is that? COVID-19 has slowed the tax assessment and protest process. As a result, the city has received an ESTIMATE of property values rather than a certified VALUE like they usually get. The city has accordingly subtracted about 3% of the estimated values. This is the amount the city anticipates property value protests will drive down appraised values – that is the “ARB Pending Discount.”

The budgeting process continues!

Other Interesting (to me) Items From the Agenda:

- The city is looking at purchasing a boat slip at Ridgewood Marina. This should reduce the response time of the Fire Department’s new rescue boat from 10-12 minutes to 8 minutes or less

- The J.H. Hines Elementary Sidewalk Project is proceeding. This week the council plans to approve an Advance Funding Agreement with the state of Texas. The project requires no local match and the City would be responsible solely for non-reimbursable costs and any overruns.

Jeffrey Vitarius has been actively local since early 2017. He lives in Sanger Heights with partner (JD) and his son (Callahan). He helped found Waco Pride Network and now serves as that organization’s treasurer and Pride Planning Chair. Jeffrey works at City Center Waco where he helps keep Downtown Waco clean, safe, and vibrant. He is a member of St. Alban’s Episcopal Church and graduated from Baylor in 2011.

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected]for more information.

This is extremely helpful and informative! Thank you for this!!!

Very informative. Thanks!!