Research reveals ‘racialized’ roots of financial exclusion

By Dexter Hall

During my many readings about financial security and understanding how we arrived at this point in time, I have run across many articles and commentary.

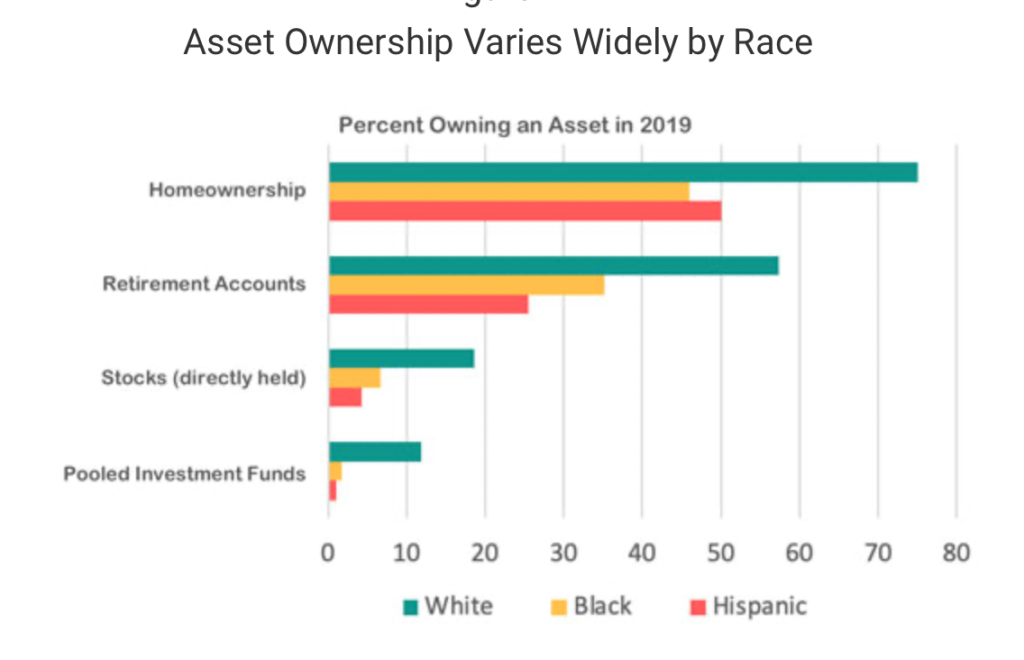

An article by Rocio Sanchez-Moyano and Bina Shrimali, of the Federal Reserve Bank, sheds light on how years of financial exclusion of Black and Brown communities have led to many of our present-day problems and issues. The article, titled “The Racialized Roots of Financial Exclusion,” reveals the fact that access alone is not enough.

We often share information about redlining and racially restrictive housing covenants that were the law of the land in cities across America that barred “negroes” from buying in areas that were deemed “white” only.

Rocio and Bina share an example from a 1950 covenant on a property in Daly City, Calif. The covenant said: “The real property above described, or any portion thereof, shall never by occupied, used or resided on by any person not of the white or Caucasian race, except in the capacity of a servant or domestic employed thereon as such by a white Caucasian owner, tenant, or occupant” (cited from Richard Rothstein’s The Color of Law: A Forgotten History of How Our Government Segregated America, p. 78‒79).

Rothstein also cited a practice called blockbusting, which “refers to the practice of telling white homeowners that Black people are moving to induce concern about forthcoming declines in property values, which sometimes led to sales at a loss that were then sold to Black people at a profit” (Rothstein, p. 95).

The Rocio and Bina article discusses in extremely clear terms how the Black-White wealth gap came to be. More importantly, the authors help us understand why there is a need for direct investment in communities of color to balance the scale that was tipped purposely and intentionally.

Understanding the intersectionality of financial security to health and educational outcomes continues to be a bedrock of creating a more thriving community for all Wacoans. This is our challenge together in creating an inclusive economy for all.

In straightforward terms, when all people win, we all win. However, when one of our brothers and sisters loses or is left behind, we all lose.

The data we previously shared from the 1934 redlining map shows us where we should expect issues and problems today in Waco because of intentional non-investment in the past. The data today, 87 years later, show large amounts of poverty persist in East Waco and parts of South and North Waco. In other words, today’s poverty map mirrors the 1934 redlining map.

Implementing the City of Waco’s Financial Empowerment Blueprint is needed now more than ever. Let’s act today to change the future of Waco.

For more information on how to get involved in [email protected]. The time is now.

Please look at the full article by Rocio and Bina, as well as the documented research included in their endnotes.

Dexter Hall is chief of staff and senior specialist for financial security with Prosper Waco.

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email Ferrell Foster at [email protected].