By Christina Helmick

Recently, we’ve been getting asked how people can become involved in the Prosper Waco initiative if they can’t attend meetings or meetings aren’t their thing. That’s a good question. We tend to focus on the many meetings that occur within the Prosper Waco initiative, sometimes we don’t communicate clearly enough that there are a plethora of ways to become involved—from subscribing to our newsletter to volunteering your time to help prepare community members to become “job ready.”

Below are five specific opportunities for you to choose to become engaged in the Prosper Waco initiative. These of course are not all of the ways, but just a few to get started.

Engage the community: Community engagement is a two-way conversation! If you are a part of an organization in town, connect with the Prosper Waco Community Engagement Council to learn how the Prosper Waco initiative aligns with your organization. If you are a community member and you want to join the conversation about the Prosper Waco initiative, host or attend a house meeting with the Community Engagement Council. A house meeting doesn’t have to be at your house—it can be anywhere!

Engage the community: Community engagement is a two-way conversation! If you are a part of an organization in town, connect with the Prosper Waco Community Engagement Council to learn how the Prosper Waco initiative aligns with your organization. If you are a community member and you want to join the conversation about the Prosper Waco initiative, host or attend a house meeting with the Community Engagement Council. A house meeting doesn’t have to be at your house—it can be anywhere!

Become a mentor: The Mentor Coalition is comprised of various organizations in our community who provide mentoring to Waco youth. There are many different ways to mentor in our community. Check out the list! You may find the perfect match for your availability, your interests and the age person you would like to mentor. LEAD, Communities in Schools and Big Brothers Big Sisters are just a few of the organizations in the coalition.

Become a mentor: The Mentor Coalition is comprised of various organizations in our community who provide mentoring to Waco youth. There are many different ways to mentor in our community. Check out the list! You may find the perfect match for your availability, your interests and the age person you would like to mentor. LEAD, Communities in Schools and Big Brothers Big Sisters are just a few of the organizations in the coalition.

Support job readiness programs: In our community, we have many organizations working hard to help Waco residents acquire the skills necessary to get and keep a job. Examples of these organizations include HOT Goodwill Industries, Christian Men’s Job Corps, Christian Women’s Job Corp and the newly created Esther’s Closet.

Support job readiness programs: In our community, we have many organizations working hard to help Waco residents acquire the skills necessary to get and keep a job. Examples of these organizations include HOT Goodwill Industries, Christian Men’s Job Corps, Christian Women’s Job Corp and the newly created Esther’s Closet.

Subscribe to our newsletter: Subscribing to the Prosper Waco newsletter will ensure you are kept abreast of the collaborative efforts that are ongoing in our community. The newsletters arrive on the first Monday of every month. Also, follow us on our Facebook and Twitter pages to receive daily updates on the initiative!

Subscribe to our newsletter: Subscribing to the Prosper Waco newsletter will ensure you are kept abreast of the collaborative efforts that are ongoing in our community. The newsletters arrive on the first Monday of every month. Also, follow us on our Facebook and Twitter pages to receive daily updates on the initiative!

Of course if you DO want to Attend a meeting you are certainly invited! At either the Steering Committee level or the Working Group level, you can join the ongoing collaborative conversations about strategies and projects that will help address the goals of the initiative. Check the “Events” tab on our website for meeting times, dates and locations.

Of course if you DO want to Attend a meeting you are certainly invited! At either the Steering Committee level or the Working Group level, you can join the ongoing collaborative conversations about strategies and projects that will help address the goals of the initiative. Check the “Events” tab on our website for meeting times, dates and locations.

As I mentioned before, these are just a few ways to get involved in the Prosper Waco initiative. If you have any interest in these opportunities, or want to learn more about them, send me an email and I’d be happy to connect you.

Getting involved with one or more of the aforementioned ways will directly contribute to moving the initiative forward. Our community is working hard to collectively improve the education, health and financial security of each person in our community. There isn’t a silver bullet to alleviating poverty in our community, but with your help, positive change not only can, but will, happen in our community.

Christina Helmick is the director of communication at Prosper Waco. She is a recent graduate of Baylor University with a BA in Journalism, Public Relations & New Media. Originally she is from Washington, D.C., but has stayed in Waco post-graduation. She is an active mentor at J.H. Hines Elementary School, enjoys spending time with her family and watching Baylor football. Sic ’em Bears!

Christina Helmick is the director of communication at Prosper Waco. She is a recent graduate of Baylor University with a BA in Journalism, Public Relations & New Media. Originally she is from Washington, D.C., but has stayed in Waco post-graduation. She is an active mentor at J.H. Hines Elementary School, enjoys spending time with her family and watching Baylor football. Sic ’em Bears!

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

(Note: This post is part of an on-going series on financial literacy. Two of the goals of Prosper Waco have to do with accumulating wealth: (1) Reduce the percentage of Waco-area households living without three months’ worth of savings if they were not able to work. (2) More than 50 percent of Waco households will have a net worth above $15,000. Our hope is that this series will help move our community towards accomplishing these goals both by sharing information about some of the challenges, complexities and practicalities of managing finances. For other posts in this series, click here: Financial Freedom. — ABT)

By Phil Oliver

Payday and Title Loans

As I shared in my last blog, I have spent many hours talking to individuals and households about honestly addressing their financial goals based on their money flow IN and the flow OUT. In my Financial Coaching, I am finding more and more cases where the short-term allure and convenience of quick (expensive) loans ended up becoming a major source of debt and despair. The complete cycle is more devastating as the flow slows. Medical bills or medicine, sickness or even car repairs, all become major setbacks in any household that basically operates from paycheck to paycheck. This is where many of the financially vulnerable turn to the predatory loan network.

Payday Loans and Title Loans are short-term (usually two week) contracts that require an upfront fee that must be paid back IN FULL in two weeks. The lenders are very willing to arrange for the “convenience” of a direct withdrawal from the consumer’s checking or debit account on payday (That’s why they are called “Payday Loans.”) More often than not, this arrangement results in additional fees and frustrations as the money needed to pay IN FULL is not available two weeks later. To make matters worse, consumers are sometimes also hit with insufficient funds or overdraft fees from their banks on top of the fees already paid for the loan. The larger the loan, the less likely the customer will be able to pay it off in the short term. When that happens, the payday lender often encourages the borrower to start another short term loan with additional fees! Most who borrow, WON’T have the money to pay off the loan in two weeks when it is due, and the cycle develops into devastating debt where eventually payments never chip into the principle at all, and interest mounts exponentially. In the case of an Auto Title loan, the period could be a month, but then thousands of dollars will be due in 30 days. In my coaching meetings, I have found this happening across the city in alarming frequency.

Since my last blog, the City of Waco has passed a Payday Lending ordinance which will go into effect on Sept. 1. This is AWESOME news for consumers in crisis! Now the lending institutions will be held to a reasonable standard of high interest and number of renewals of the loan. They will also be tasked with making sure the loan is not a crippling percentage of the customer’s take home pay. There will be grievance procedures in place for residents to file when lending institutions don’t follow the ordinance.

For more information on this important topic, I HIGHLY recommend contacting The Waco Citizens for Responsible Lending. And keep an eye out for an upcoming “Predatory Lending Training and Update. ” This session will include roundtable discussions concerning predatory lending updates at the federal, state, and local level as well as steps to get involved in your community. Special guest speakers will include Ann Baddour, Director of the Fair Financial Services Project at Texas Appleseed as well as staff from the City of Waco. For more information about Waco Citizens for Responsible Lending, or to get on the list to receive information about the “update” when it is scheduled, please contact Meilana Charles at 254-757-5180 email [email protected] or Tiffany Fry at 254-753-7337 email [email protected]

Student/College Debt

My biggest shift in the last few years with all those I talk with is to emphasize a common investment phrase…. “Return On Investment (ROI).” In regard to a college education, I highly recommend most high school students attend MCC or TSTC to start their studies for ANY degree or certification. These institutions provide a seamless path to job security through an associate’s degree or 4- year college by transfer or at MCC under the University Center opportunity. This combined with dual-credit classes in high school can allow residents to fully enter the job market or an undergraduate degree much more rapidly and with minimal debt.

It is not unusual now for graduates to build up a $40-60,000 student debt while earning an undergraduate degree. This often means up to 20-30% of their take-home pay is committed for long-term debt repayment. This is a huge issue especially when combined with housing costs which can require an additional 40-50% of take home pay. If you add that up, it means that there is only 20-40% left for ALL other living expenses!!

This is where the concept of Return on Investment (ROI) becomes so important. It is financially smart to think carefully about the ROI when planning for college and career. Of course it’s important to consider passion, talents and general interest – adding some consideration of average starting salaries and job availabilities rounds out a healthy equation for financial freedom. In most cases, there are many choices for career paths that are possible that use similar skill sets and training. Most college advisors and high school counselors can offer information for future job salaries, demand data, and trends.

Another consideration to reduce college debt, is the ability to transfer as many credits as possible from the community college. One of the best opportunities here in our area is the MCC University Center program. It allows residents to dually enroll in MCC and a partnering 4-year University while staying in Waco and paying much reduced hourly tuition. It also guarantees the acceptance of credits earned at MCC and puts NO LIMIT on the cumulative number of transfer hours!! Considering that most 4-yr Universities will only allow up to 60 hours to transfer toward a degree, having no limit for transfer hours with partnering Universities could allow any student to actually transfer in as a senior!! This is a HUGE consideration when it comes to debt!

To find out more of about this unique program go to http://uc.mclennan.edu.

We are blessed to have some great resources in our Waco community for growing financially healthy. Our area is also fairly unique in the amount of networking and collaboration being practiced, especially through the new and expanding Prosper Waco initiative. I have been actively involved in this amazing collective and see the growing influence and investment they are creating for our community. Please check out their website and resources at prosperwaco.org, as well as the recommended FREE, foundational curriculum adopted by Prosper Waco for financial training from the Dallas Federal Reserve Bank called “Building Wealth”. That material is available for a FREE download at https://www.dallasfed.org/assets/documents/cd/wealth/wealth.pdf

In my next blog, we’ll look at the 3 main financial ways that deficits in a monthly flow can be addressed and brought into balance. If you have any questions, please feel free to e-mail me directly: [email protected]

Phil Oliver is a retired educator. He is an independent Financial Coach, active mentor, and community activist. He has spent the last 8 years empowering individuals and families to take charge of their finances through his FLOW system. He is active in many community efforts to grow financial literacy and responsibility including Prosper Waco and Citizens for Responsible Lending. He consults with many local organizations to teach and inspire their efforts to empower clients in personal finances. You can contact him at: [email protected]

Phil Oliver is a retired educator. He is an independent Financial Coach, active mentor, and community activist. He has spent the last 8 years empowering individuals and families to take charge of their finances through his FLOW system. He is active in many community efforts to grow financial literacy and responsibility including Prosper Waco and Citizens for Responsible Lending. He consults with many local organizations to teach and inspire their efforts to empower clients in personal finances. You can contact him at: [email protected]

By Deshauna Hollie

Waco is home and the experience of living here is like no other. I am currently a student studying education, Curriculum and Instruction. I’ve been a student before, lots of times in fact. I love learning, I love the process of learning, and I also love sharing what I have learned. Yet it took a long time before I realized that I should probably consider teaching. Although the name “Curriculum and Instruction” does little to suggest the artistic and philosophical nature of that field of education, it is indeed a creative and innovative field with a focus on 21st century learning and education. Curriculum and Instruction deals with the questions of: How we learn and Why we learn? It uses the answers those question to help determine the best ways to educate students for success, in a constantly evolving world.

One of the most fascinating insights that I have come across is that the biggest factors that indicate a student will achieve and be successful have nothing to do with how well a student does on standardized testing, their socio-economic class, English language ability, learning difference or even their ethnicity. I think that we all are aware that these things are in no way indicative of a child’s intelligence. Along with access to high quality curriculum, and parent and community support — having educators and an education system that believes in them is one of the biggest indicators that students will succeed and achieve.

That’s what I experienced during most of my time as a student in Waco ISD many years ago. It was so influential that it inspired me to write an ode to my favorite school district. Here goes:

My ode to Waco ISD, the only school district I have ever known

To second grade teachers who read to us ever day after lunch

To high school English teachers who made sure we could write research papers

without using “to be” verbs, but who also introduced us to mock weddings, Charles Dickens…

My ode to biology model cells,

My ode to South Waco Elementary and the Apple Core Brigade…

My ode to the great and mighty G.W. Carver Academy where

We knew not what a text book was, but Odysseys kept us engaged in

Learning like no other…

My ode to learning that taught us

Fun words like “metamorphosis” in the forms of optical illusions and dystopia lit…

My ode to block schedules that allowed

Countless students the prestige of early graduation

So that they may forever be admired for their

Advanced Intelligence

My ode to the innovation of a district

That constantly embraces change

21st century learning always on the forefront of it’s mind…

My ode to Waco ISD

Where teachers, parents, community members and administrators alike

Are always succeeding…

DeShauna Hollie is currently working on Master’s of Arts in Curriculum and Instruction at Greenville College. She is an aspiring teacher and hops farmer. She grew up in Waco and is happy to have returned after living in the Midwest and on the East Coast for awhile.

DeShauna Hollie is currently working on Master’s of Arts in Curriculum and Instruction at Greenville College. She is an aspiring teacher and hops farmer. She grew up in Waco and is happy to have returned after living in the Midwest and on the East Coast for awhile.

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

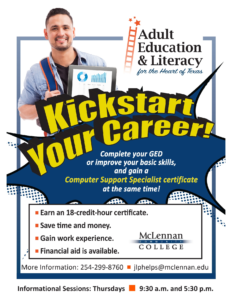

By Janet Phelps

It can take years for a student to get a GED and finish college. Take, Patty*, for example, who started studying for her GED® in 2014 after dropping out of the 10th grade many years earlier because of a tough situation at home.

Patty completed her GED® just eight months later but continued to work minimum wage factory jobs to support her kids as a single mom.

Last fall, Patty took a CNA class and got a full-time job. She leveraged her newfound stability to take a FastTrack to College class, and then started classes toward her nursing degree at McLennan Community College this spring.

That should be the happy ending to Patty’s story— but it’s not.

She still has to complete her remedial class requirements at MCC while working full-time and struggling to make ends meet. She’s years away from that salaried job she desperately needs.

The length of time it takes people in Patty’s situation to first attain a GED, then complete remedial classes (which don’t typically count toward a degree), and THEN complete classes for a degree is often just too much. Many students drop out along the way. For many, the path is too long to be practical – too many things can go wrong along the way.

MCC is starting a program this spring through a grant from the Higher Education Coordinating Board to help students like Patty achieve their goals. This new Career Pathway option will allow students who dropped out of high school, or who need academic helps to be successful in college, to begin earning college credit more quickly.

Classes begin in May for the first pathway which will result in a Computer Support Specialist Certificate.

The program is designed for students to finish six courses (18 credit hours) and complete their GEDs® in two semesters (Summer and Fall) —bypassing the remedial courses that most students have to take when they start at MCC. Participating students will also get the chance to work toward achieving a work readiness certificate during the class.

Students will be able to go to work immediately when the courses finish in December, and the 18 hours of college credit they earn will also give them a good start toward earning a one or two-year degree in one of five areas at MCC: Computer Information Systems and Applications, Computer Applications, Paralegal, Administrative Assistant and Medical Office Assistant.

MCC’s Adult Education & Literacy Department also plans to partner with Communities in Schools (CIS) to provide paid work experience for students in this program who meet CIS’s eligibility requirements.

MCC is seeking to enroll 15 students without a GED® or high school diploma into this program. If qualified and accepted, MCC will pay for a student’s credit classes until the student demonstrates the success that’s required to qualify for federal financial aid (See: Ability to Benefit). The program is also open to students who have a high school diploma but who need academic remediation or English language help in college. Students who enroll will get academic and social support plus financial help with textbooks and supplies in addition to free tuition at MCC and free GED education.

The Computer Support Specialist certificate is part of the goal of MCC’s Adult Education & Literacy Department to boost the academic and career skills that low-income adults need to get ahead.

Please help us get the word out about this opportunity. To learn more, feel free to contact me. My email is [email protected]. Or, you can call 254-299-8760 or come to an informational session on Thursdays at 9:30 a.m. or 5:30 p.m. on MCC campus.

Computer Support Specialist Certificate Career Pathway

May – December 2016

Career Pathway Informational Sessions

Thursdays at 9:30 a.m. and 5:30 p.m.

Room E224, Community Services Center

McLennan Community College

For more information Contact Janet Phelps: [email protected]

Janet Phelps is the Transition Specialist for Adult Education and Literacy for the Heart of Texas at McLennan Community College. She loves helping students, reading, and running at Cameron Park.

Janet Phelps is the Transition Specialist for Adult Education and Literacy for the Heart of Texas at McLennan Community College. She loves helping students, reading, and running at Cameron Park.

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

*Patty is not the student’s real name. We used a pseudonym to protect this student’s privacy.

By Amy Grace

March is Red Cross month! That time of year in which we—along with community leaders, partners and volunteers—recognize how the American Red Cross helps people down the street, across the country and around the world.

As we wrap up the month, I wanted to share how the Red Cross is helping our local community in very practical ways that most people never even hear about.

In 2015, the Red Cross responded to 85 McLennan County families who lost possessions, pets, clothes and, in some cases, their entire home to a fire, flood or tornado. Our incredible team of volunteers and staff deploy to help any family in our community devastated by disaster, no matter the nationality, ethnicity, income level or even citizenship of the victims…we provide relief. Period. And we are on call to respond 24/7, 365 days a year without question, right here in Waco.

In 2015, the Red Cross responded to 85 McLennan County families who lost possessions, pets, clothes and, in some cases, their entire home to a fire, flood or tornado. Our incredible team of volunteers and staff deploy to help any family in our community devastated by disaster, no matter the nationality, ethnicity, income level or even citizenship of the victims…we provide relief. Period. And we are on call to respond 24/7, 365 days a year without question, right here in Waco.

Additionally, throughout 2015, 1,861 McLennan county residents were trained to provide life-saving skills such as CPR, First Aid, Water Safety, Babysitting and more. That’s 1,861 more of us who are able to jump in and help save lives when needed, and that need could happen anywhere – restaurants, the grocery store, sports events – you just never know!

And lastly, did you know we have an entire arm of the Red Cross dedicated to serving and assisting our military, active and retired? Not only do we provide volunteer assistance to service members at local VA hospitals, but we also provide mental health services and reconnect military families across the globe who have been separated by war, tragedy or circumstance. In 2015, we provided assistance to military families and service members 262 times in McLennan County.

In other words, the Red Cross is here, supporting and providing relief in many ways to people in our own back yard every day. If you would like to join us in volunteering here in your own community, we would love to have you! Our volunteers are our life-blood, and we are proud of and grateful for every one of them! To register as a Red Cross volunteer, please visit www.redcross.org/volunteer. Enter your zip code and choose volunteer opportunities of interest, or if you don’t see something of interest in the listed opportunities, complete your profile anyway and call our office to talk about other volunteer options.

April 7 – Volunteer Teams of HOT American Red Cross Meeting – Naomi Dews, Volunteer Services Specialist and Trevor Sikes, Disaster Services Specialist will be discussing ways volunteers can provide relief to those affected by disasters and help people prevent, prepare for and respond to emergencies. Prospective volunteers are welcome to attend. Cost: FREE. Time: 6:30 PM. Location: 4224 Cobbs Drive. For more information, please call 254-523-4985 ext 1109 or email [email protected].

Amy Grace is a native Texan and is serving our community as the Executive Director of the Heart of Texas chapter of the American Red Cross. She has an extensive professional background but is most proud of being a mom to her incredible four-year old daughter and paying forward a legacy of courage, resilience, hope and abundance. She currently resides in Temple with her daughter, two canine family members (Ranger and Silver) and her grandmother.

Amy Grace is a native Texan and is serving our community as the Executive Director of the Heart of Texas chapter of the American Red Cross. She has an extensive professional background but is most proud of being a mom to her incredible four-year old daughter and paying forward a legacy of courage, resilience, hope and abundance. She currently resides in Temple with her daughter, two canine family members (Ranger and Silver) and her grandmother.

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

Amy Grace,

Executive Director

By David Saucedo

My brother, Robert Saucedo, and I have always had a desire to impact today’s culture. Between us, we have been blessed to work on many exciting projects that we believe are having a significant positive influence on the public, private and non-profit sectors in the Waco area. We didn’t know it, but we have been preparing for our newest project our whole lives. It’s called “Hope through Concrete.”

My brother, Robert Saucedo, and I have always had a desire to impact today’s culture. Between us, we have been blessed to work on many exciting projects that we believe are having a significant positive influence on the public, private and non-profit sectors in the Waco area. We didn’t know it, but we have been preparing for our newest project our whole lives. It’s called “Hope through Concrete.”

You might not immediately associate the words “Hope” and “Concrete,” but for my brother and I those two words fit together perfectly. Robert and I grew up working in concrete. We come from a family that has been involved in the concrete industry for over 40 years. Eventually we both landed careers in the precast concrete industry. Robert is a certified concrete technician and quality control supervisor; and I am a Safety Coordinator and training developer, also with industry certification. Now we are working to combine the skills and expertise we have developed working in the concrete industry with our desire to be a positive influence in the community.

We have started a concrete company, Saucedo Brothers, and are partnering with Life Church Waco, Pastor Gabriel Dominguez (Pastor Gabe), and the job creation/discipleship efforts of Hope Through Everything, a 501c3 Non-Profit here in Waco. The tagline of Hope Through Everything is “Moving Forward Despite our Struggles.” Here’s a part of the description from the website of what Hope Through Everything is working to do:

Hope Through Everything exists to disciple and provide jobs to those who are committed to God, are going through the systems established at “Life Church Waco,” and who are below the poverty line and/or who once were incarcerated or living the “street life” and are now choosing life change…

Our goal is to create jobs where this population can learn how to show up consistently and on time, handle responsibility, and gain employable skills in a safe and loving environment…

We do not want to provide jobs to just anyone because they need a job, but rather because they truly want one. We have healthy accountability systems already in place to ensure everyone we accept into our program is there because they want to be…

Robert and I agree with Pastor Gabe that people, especially young people, need an opportunity to learn fundamental work ethic and basic work skills. We vow to use our business to finance “Hope Through Concrete,” where young men and women seeking life change can find the guidance, training, spiritual growth and WORK they need to move forward despite their struggles. Our vision for “Hope Through Concrete” is a company that disciples young men and women as they learn the trade.

This approach is not only good for the young people who work for us, we think it makes good business sense. We call this concept “Foundational Employment.” Employers are in a good position to invest in employees in a way that helps employees build a solid foundation for their lives. Employers who are willing to make that investment will reap the benefit of high quality, loyal employees. We intend to run our company on that principle. As Robert says, “We believe companies would benefit by investing in the lives of their employees … sometimes it’s easier to show possibilities rather than preach them. The vision we have for our company is one of transparency and purpose, all employees at Saucedo Brothers will be invested in.”

We are currently constructing a 6500 square foot parking lot and custom design retainer wall for the Masonic Temple at 724 Washington Avenue. Jon S. Spann, President of the board for the York Rite Library and Museum that owns the Masonic Temple, understands our vision, “The York Rite Library and Museum of Texas is dedicated to the preservation of the history of the York Rite, this includes The Masonic Temple building itself. We also seek out the opportunity to support local programs that benefit our community in and around the Waco area. Our faith is our guiding light in all that we do.”

We are currently constructing a 6500 square foot parking lot and custom design retainer wall for the Masonic Temple at 724 Washington Avenue. Jon S. Spann, President of the board for the York Rite Library and Museum that owns the Masonic Temple, understands our vision, “The York Rite Library and Museum of Texas is dedicated to the preservation of the history of the York Rite, this includes The Masonic Temple building itself. We also seek out the opportunity to support local programs that benefit our community in and around the Waco area. Our faith is our guiding light in all that we do.”

We are also already working with Cory and Kate Duncan. In a December 2015 article, the Waco Tribune said “Cory and Kate Duncan have been praised as the type of young, aggressive business owners that downtown Waco needs.” Cory, a real estate developer and Waco native, recently acquired nearly 14,000 square feet of space in the 700 block of Washington Avenue. Approximately 4,000 square feet of the development has been set-aside for Wildland Supply Co., a business founded and operated by his wife, Kate.

The Duncan’s admire the vision for Hope Through Everything and will be calling upon us for all of their concrete needs, including work on the renovation of their 1926 Cameron Park estate. As Cory says, “When exploring your options of contractors to use, you must look for the perfect balance of skill, experience, and price. The ability to support a good cause is icing on the cake. These guys are very transparent, very professional, and passionate about serving our community, we are excited about working with them on future projects.”

As Saucedo Brothers and Hope Through Concrete continue to work with developers and entrepreneurs like The Duncan’s, our vision is that the company’s reach will continue to spread Hope throughout the Waco area.

We need your help to grow! We can handle house foundations, building foundations, parking lots, custom designed retainer walls, sidewalks, patios, we love what we do and no job is too big or too small! Our business model is transparency. We will show you what it takes to get the job done, and explain what our aim is for a reasonable profit. We will provide testimonials about the lives impacted by your project. Visit www.hopethrougheverything.org and let us provide your concrete needs!

This Act Locally Waco blog post was written by David Saucedo. David is a local minister with Life Church Waco and has committed the last 8 years of his life to impacting his community in a positive way. David has a loving wife, Michelle and three beautiful children, Lianna (7), Isaiah (4) and Isaac (10 Months).

This Act Locally Waco blog post was written by David Saucedo. David is a local minister with Life Church Waco and has committed the last 8 years of his life to impacting his community in a positive way. David has a loving wife, Michelle and three beautiful children, Lianna (7), Isaiah (4) and Isaac (10 Months).

The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

By Diego Loredo

College isn’t easy, trust me I know. I’ve been in college for two years and will be heading into my junior year this fall. I know the struggles of going to college. However, lately I’ve been hearing about a lot of my friends going back to Waco after spending a semester or two at a university out of town.

They either transfer to MCC or just stop going to college. Now there’s nothing wrong with going to MCC, my sister is going there this fall, but it surprises me that some of my friends decided to leave their university. I know they are all smart people and are perfectly capable of attending a university. When I asked them why, most of them said they just couldn’t handle going to a university away from home. I fully understand this and wrote this blog hoping to help them or anyone else who is struggling to adapt to a college away from home.

From personal experiences, I have gone through my fair share of struggles at UNT. I’ve bombed exams, met people I didn’t get along with, and I even failed a class last semester. I know there are many different reasons for college being tough such as, difficult classes, financial issues, homesickness, etc. But to me college is basically just learning through trial and error, and here are a few things I’ve learned that may help someone who is struggling in college.

Make a group of close friends

It always helps to have some friends you can rely on and this will make going to a college away from home much easier. I already had a few friends going to UNT, plus my roommate was a good high school friend of mine, but I thought I would still struggle to make new friends in college. However, I made friends almost instantly during my first week there and it turned into having my own little group of close friends. We always hang out and I know that I can rely on them to help me out with anything. Every college student needs a group like this and if you can find a few close friends then that’ll make the transition into college a lot smoother.

Don’t go home that often

I know this may be tempting but it’s best to not go home that often if you go to a college out of town. Unless, you have a specific reason that requires you to go home I think you should stay in the city that your college is in. Now this doesn’t mean don’t go home at all, I’m just saying don’t go home every weekend. If you do this, then you’ll never get used to being away from home. I know a few people who go home every weekend and I try to convince them to stay in Denton but they never do. There are so many things to experience in whatever city you’re in. You’ll be missing out on the full college experience if you’re back at home every weekend.

Find a tutor

For those who are struggling in classes, find a tutor! I know there’s some kind of learning center at your college. You’re paying for it so might as well use it right? Finding a tutor will not only help you in class, but it might even help you enjoy the class more. We all have those classes that we absolutely hated, for me it was Elementary Probability and Statistics, but having a tutor will help you get through it and not stress too much.

I’ll admit it, college isn’t for everyone. Some will enjoy it more than others and it can be absolutely nerve-wracking at times. But, you never know until you try. Going to a college away from home has been such a great experience so far and I highly recommend it to anyone who wants to go to college. I know it’s harder than staying at home but I promise it’s worth it.

Diego Loredo is a sophomore at the University of North Texas. He is majoring in public relations. He graduated from University High School in 2014. Although he is still not quite sure what exactly he wants to do, he thinks he wants to work somewhere in sports PR (preferably soccer or college football). His hobbies include playing soccer and golf. He is 19 years old.

Diego Loredo is a sophomore at the University of North Texas. He is majoring in public relations. He graduated from University High School in 2014. Although he is still not quite sure what exactly he wants to do, he thinks he wants to work somewhere in sports PR (preferably soccer or college football). His hobbies include playing soccer and golf. He is 19 years old.

The Act Locally Waco blog publishes posts with a connection to these Aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

by John Fitch

If you were to conduct a survey about great cities for technology innovation it is unlikely that Waco would even make the list.

There actually is a list.

Waco is not on it.

One list to look at is the Streetwise Innovation Index . This index presents the top 50 cities for innovation in America by reviewing a number of factors: technology sectors represented, venture funding available, higher education enrollment, livability, and overall economy. Four cities in Texas were identified as providing the most promising climates for technology startups: San Antonio (8th), Houston (11th), Austin (12th), and Dallas (21st).

Looking at the five areas making up the index, we see that Waco holds the key elements already and is rapidly improving in each area.

Let’s start with an easy one – livability. Waco has clearly hit a critical mass in the past few years that is making a positive difference in livability. If you just compared the number of food trucks in Waco today versus 5 years ago that would be enough to settle the argument. But there is much more. A real resurgence downtown, the completion of the McLane stadium and it’s embracing of the river, Fixer Upper and the Silos, the Baylor Research Innovative Collaborative, Loft living, and so much more. Waco is not an Austin and probably never will be. But interestingly because of that critical mass, new graduates more and more are seeing Austin as a place to visit but Waco as a place to live and embrace community. This is one of the keys to technology startups – keeping young, energetic, bright minds engaged and locally involved.

The overall economy is also a key factor for the list. In general terms, the economy of Waco is not significantly different than the four Texas cities cited above. That is, the Waco economy is both good and sufficient to attract and support a diverse workforce including multiple workers in a family. Waco companies also span many technology sectors such as aerospace, medical products, and logistics providing broad opportunities for varied skills and interests. A very real difference in the Waco economy is the lower overall cost of living. Month to month cash flow is always a problem for new development. A reduced cost of doing business (both overhead and operations) makes a tangible difference between wanting to innovate, expand, or hire and actually doing it.

What about higher education? Successful technology startups must rely equally on technical and business acumen. Waco has always had a strong entrepreneurial culture fostered in large part by graduates from the Baylor School of Business. In the past decade, the Baylor School of Engineering has grown to a significant size adding Ph.D. programs and funded research in Electrical and Mechanical engineering. These are critical steps towards Baylor’s stated goal of becoming a top tier research University. Available interns, graduates and collaborative opportunities provide the personnel needed to design and develop new technology. Often the engineering students have strong ties to the business school or entrepreneurial programs helping to build the culture and tools of successful innovation.

Waco also has another educational jewel that cannot be overlooked for innovation – Texas State Technical College. Having well-trained, locally available technicians for prototyping, troubleshooting, and manufacturing new technology is a unique asset for Waco. The various programs at TSTC provide excellent graduates in all areas of mechanical, electrical, and optical technology. Their workforce development programs can also be critical to rapidly providing a trained workforce for scaling a successful innovation.

What about Venture Capital? Two major points here. First, although there are real opportunities for locally available capital for technology startups, in today’s world this is not a requirement. You could make the argument that it should be at least regional. If so then Austin, Dallas, San Antonio and Houston are all easily accessible. The second point was made succinctly at a recent meeting with a Chicago based venture capital firm at the BRIC – “today’s $500,000 is yesterday’s $5 Million”. Technology itself has made the cost of innovation much less than it used to be. Because that cost has come down dramatically, the opportunity for local financing has improved dramatically. The Waco Chamber of Commerce is actively working to encourage just this type of modest local investment in local innovations and business startups.

Finally, Waco has a host of resources primed and available for technology innovation. More and more there are capable, experienced, tech savvy small businesses in Waco eager to collaborate. These cover the range of expertise from design, manufacturing, prototyping, 3D printing, software development, analytics, cloud services, etc. Waco even has a MakerSpace that enables DIY prototyping without large capital costs.

The McLennan Small Business Development Center provides a host of start up support including experienced technology development coaches like Jane Herndon. They sponsor a variety of events to foster innovation and business startup, and they have the connections to other regional and national resources you may require as innovations mature.

Baylor provides multiple resources and entrepreneurial groups including the Baylor Angel Network and the Launch Group. Baylor University in partnership with Waco, Bellmead, TSTC, and many others, leads the Baylor Research Innovative Collaborative as a state of the art research facility that is putting Baylor research, TSTC, Launch, and large and small businesses under one roof to foster technology development and commercialization in Waco. In less than three years of operations it’s already making an impact with all four of last year’s Waco Business Innovator finalists directly linked to developments taking place in the BRIC.

So why Waco, why now for innovation? With everything Waco has going for it, the better question for your innovative idea is – why haven’t I started?

John Fitch is an Engineer, Space Physicist, and inventor. He has lived with his family in Waco since 1994. John founded Birkeland Current in 2009 as a small business that develops enabling technical concepts into mature prototypes ready for business startup. Birkeland Current’s joint venture with Pruf Energy Solutions recently won the 2015 Business Innovator award from the Waco Chamber of Commerce. Birkeland Current’s offices and labs are in the Baylor BRIC. The website is www.birkelandcurrent.com.

John Fitch is an Engineer, Space Physicist, and inventor. He has lived with his family in Waco since 1994. John founded Birkeland Current in 2009 as a small business that develops enabling technical concepts into mature prototypes ready for business startup. Birkeland Current’s joint venture with Pruf Energy Solutions recently won the 2015 Business Innovator award from the Waco Chamber of Commerce. Birkeland Current’s offices and labs are in the Baylor BRIC. The website is www.birkelandcurrent.com.

The Act Locally Waco blog publishes posts with a connection to these Aspirations for Waco. If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.

By Sandra Arias

I’ve always had large ambitions of traveling to new places. When I first heard that I would be heading to Nashville, Tennessee for the National League of Cities Conference I knew that I was in for a great time.

For the past two years I have served on the Waco City Youth Council, an organization dedicated to helping the youth of Waco become more active in the community. Within this organization I have been a part of many wonderful projects such as fundraising for the Waco Humane Society and donating gifts to some of the five hundred foster children in McLennan County. Annually, the Waco City Youth Council, along with the Waco City Council, travels to the National League of Cities Conference. Delegates from across the country meet at this conference every year to discuss local issues, and hear from speakers who have made a great impact in their communities.

This year I, along with five other students from Waco, attended this conference as youth delegates. Never in my life had I left the state of Texas, let alone been on a plane, and for me to travel to the country music capital was inconceivable. There are not enough words to express the excitement I felt. Weeks prior to our departure my good friend and fellow delegate, Kristen Petree, and I spent our time planning everything we wanted to do when we landed in Nashville. However, to actually be in the city was a breathtaking experience.

This year I, along with five other students from Waco, attended this conference as youth delegates. Never in my life had I left the state of Texas, let alone been on a plane, and for me to travel to the country music capital was inconceivable. There are not enough words to express the excitement I felt. Weeks prior to our departure my good friend and fellow delegate, Kristen Petree, and I spent our time planning everything we wanted to do when we landed in Nashville. However, to actually be in the city was a breathtaking experience.

On November 2, 2015 we departed for Nashville, Tennessee. As we landed in the grand city, it was very clear that it was a vibrant place filled with great energy. On our first day we made our way to the Music City Center, one of the largest convention centers in the country and got a first glimpse of the convention. Thousands of people gathered in this large building, spanning the length of five city blocks, for the sole purpose of finding ways to improve their city. We also met with several other youth delegates from all around the country. What was astounding to me was that so many of these young adults, like myself, cared very much about their community. One of the major highlights of this trip was hearing Vice President Joe Biden speak. In his speech he highlighted the importance of small businesses, and the vital necessity of city infrastructure to bring in companies that could provide jobs for our citizens. Within our small  city of Waco, I believe that we truly embrace the words of Vice President Biden. In Waco, we embrace our small businesses with the hope that our citizens will prosper. We have also done well by providing the infrastructure needed to house large companies such as M&M Mars, which employs many people in the area.

city of Waco, I believe that we truly embrace the words of Vice President Biden. In Waco, we embrace our small businesses with the hope that our citizens will prosper. We have also done well by providing the infrastructure needed to house large companies such as M&M Mars, which employs many people in the area.

During the rest of my stay in Nashville I enjoyed a variety of other things. Our group had plans to consult with various companies about their proposals for developing our city. We met with council member Alice Rodriguez on several occasions to discuss with her all that we had seen and heard. The Nashville youth delegates gave us a tour of the city and its historic sites. We were also treated to a private concert by some of Nashville’s up and coming artists.

Overall, my journey to Nashville was spectacular. I was able to meet many great people who provided me an outsider’s perspective of my wonderful city. I am very grateful to the Waco City Council, as well as the Waco City Youth Council for allowing me to attend this wonderful trip. In the end, I learned about many ways to improve my community, and I plan to employ what I learned to help our community prosper.

Do you know a young person who might be interested in Waco Youth Council? The Waco Youth Council’s primary function is to provide the Waco City Council a teen perspective on issues facing the City, and to provide a voice for teens in the community. The group typically volunteers at functions such as the annual Feast of Sharing, Brazos River Cleanups, and at community center events such as Easter Egg Hunts and Halloween carnivals. Applications are available from high school counselors, or by emailing Earl Stinnett at [email protected]. The deadline to apply is Thursday, April 21, 2016. <Youth Council Application> <Youth Council Information Sheet>

Sandra Arias is a senior at Waco High School, with plans to attend the University of Texas at Arlington this fall. She will major in science and exercise, and hopes to earn her Master’s degree in athletic training. She is very involved in Waco High’s student athletic training program, and has also been a part of Waco High’s cross country, track, and Lady Lion soccer teams.

Sandra Arias is a senior at Waco High School, with plans to attend the University of Texas at Arlington this fall. She will major in science and exercise, and hopes to earn her Master’s degree in athletic training. She is very involved in Waco High’s student athletic training program, and has also been a part of Waco High’s cross country, track, and Lady Lion soccer teams.

By Ashley Bean Thornton

My mom worked so hard on me! My whole childhood was a series of experiments to see if she could instill in me what she called “social graces.” One of her failed experiments was dance lessons. Ugh! When I was seven or eight she signed me up for tap and – double ugh! – ballet. I had no sense of rhythm and I couldn’t really tell my right from my left…hopeless!

Fast forward 45 years or so. My friend Shirley Langston tells me she is starting a Dance Troupe. (I suppressed an “Ugh.”) Miss Shirley runs Restoration Haven, a ministry in the Estella Maxey Complex. She was going to partner with Joy’s School of Dance to provide dance lessons for “her girls” who lived there in the public housing. Really? I thought. Wasn’t there something more important she could be doing for those girls? Maybe something having to do with school work or computers? She was so excited about it though, that despite my prejudice against dance lessons, I accidentally caught some of her enthusiasm.

She named the troupe “Miriam’s Army.” I went to one of their first recitals, a Christmas show complete with red-nosed reindeer and Angels. Since that early show a year or two ago, Miriam’s Army has performed at Juneteenth celebrations, the Waco Cultural Arts Festival, and no telling how many other events around town. Last week I saw them perform at the NAACP 80th Anniversary Gala. They stole the show dancing their hearts out to “Baby Love” and “Heat Wave” among other familiar favorites. When they finished, the crowd jumped to their feet and gave them a long, loud standing ovation.

Four dancers from Miriam’s Army visit with School Board President, Pat Atkins. (Photo bombing mom in the background!)

After their moment in the spotlight, the dancers marched back to the tables reserved for them and sat through the rest of the banquet program. It was a fine program, but I can’t imagine it was terribly interesting to a bevy of tween-age and teen-age girls. They sat through it though, with just the occasional restless tapping of their still tap-clad toes, minding their manners and politely pretending to listen. When the event was over, I noticed four of them walk up to WISD School Board President Pat Atkins, introduce themselves, and engage in a some pleasant after-dinner conversation.

Here’s what occurred to me as I watched the four young girls in fringed, sequined dresses with peacock feathers in their hair carry on a conversation with the school board president: These young ladies are learning some social graces!

“Social Graces,” it turns out, is code for “basic stuff you need to know to pave the way for yourself in the big, wide world.” The girls in Miriam’s Army are learning things like being on time to get on the van to go to practice, keeping up with their gear, and working on something they are not good at until they get good at it. They are learning to smile even when they are nervous. They are learning how to sit still during a speech even though it’s boring, how to manage at least the basic etiquette involved in a banquet, and how to introduce themselves and have a polite conversation with a grown-up person they don’t really know. Would I be able to have the job I have now, the life I have now, if I hadn’t learned these kinds of things somewhere along the way?

Being a part of Miriam’s Army is about more than sequins and Motown. It’s about life. Dance team isn’t just a fun, frivolous “extra” that successful people can afford to provide for their children; dance team (and other similar opportunities) is where those children learn how to become successful people.

I did manage to pick up some “social graces” along the way, and they are so automatic to me now that it feels like I was born knowing them. But, I wasn’t. I learned them somewhere – if not in dance lessons, then at speech tournaments, or in choir, or drama or some other opportunity that I probably took for granted at the time. You can’t learn all these kinds of lessons in a classroom. You learn them by doing something that requires you to perform in public, something that exposes you to new social situations and requires you to meet new and different kinds of people. When you think about it, children who miss out on these kinds of opportunities are missing a crucial part of their education — just as if they had missed the week in school when you learn about percentages. When you think about it a little longer, you realize that these kinds of opportunities cost time and money, something that the moms in Estella Maxey don’t often have in great supply.

The moms in Estella Maxey want the same thing for their daughters that my mom wanted for me. With the help of Miss Shirley and Joy’s School of Dance, more of them are able to provide their girls opportunities to develop the “social graces.” We should all want that for these girls. The confident tap-dancers who are introducing themselves to the school board president now will be the confident young women who are introducing themselves to college admissions officers and employers in the very near future. We all benefit if they are successful!

Would it give you joy to help support this ministry? A dance troupe requires dance outfits. Miriam’s Army saves money by purchasing their outfits second hand. They purchase three outfits every spring, one each for ballet, tap and Hip-Hop. Their invoice for outfits this year is around $3,000. The girls and moms have worked really hard selling popcorn and raffle tickets in addition to paying a hard-won $25 registration fee. They have raised over $1,000; they need to raise about $2,000 more. Contributions designated for Miriam’s Army can be sent to Restoration Haven, P O Box 875 Waco TX 76703 or donate on-line by clicking here: restorationhaven.org/donate.html.

This Act Locally Waco blog post is by Ashley Bean Thornton, the Manager of the www.www.actlocallywaco.org website and the editor of the WHOLE Enchilada newsletter. The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco.

This Act Locally Waco blog post is by Ashley Bean Thornton, the Manager of the www.www.actlocallywaco.org website and the editor of the WHOLE Enchilada newsletter. The Act Locally Waco blog publishes posts with a connection to these aspirations for Waco.

If you are interested in writing for the Act Locally Waco Blog, please email [email protected] for more information.